Lets explore the SoundHound AI company from my personal experience, Its offers an independent voice AI platform designed to boost businesses across various sectors to deliver top class conversational experiences to their client.

This technology provide speed and accuracy. Its allow to interact between human and products or services like how two people communicate with each other verbally.

SoundHound is the trusted choice of enterprises worldwide, including industry leaders like Hyundai, Mercedes-Benz, Pandora, Qualcomm, Netflix, Snap, Square, LG, VIZIO, KIA, and Stellantis.

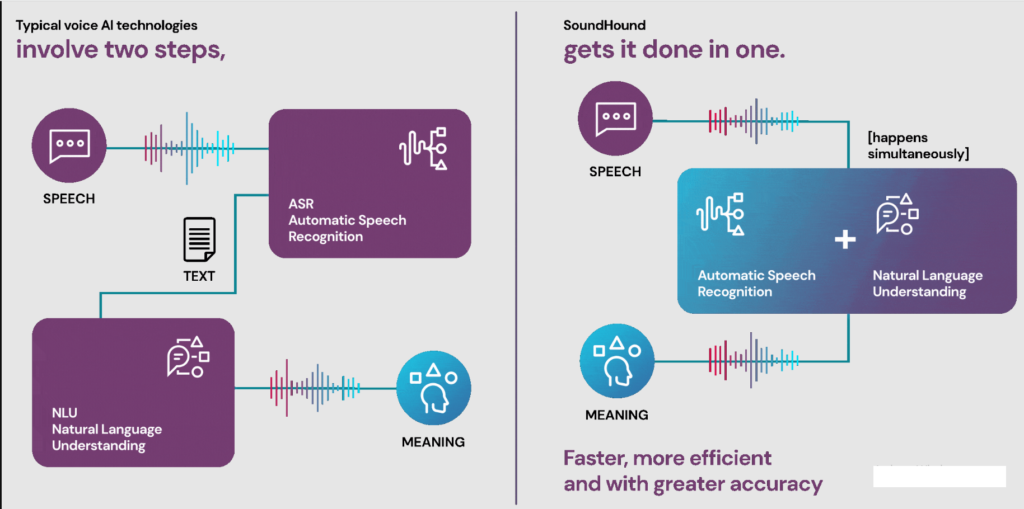

SoundHound stands out as the sole Voice AI Platform capable of processing speech and transform meaning simultaneously.

SoundHound AI specializes in advancing voice enabled AI and conversational intelligence technologies.

Emerges as the premier independent AI platform, empowering developers and businesses to deploy it flexibly while retaining control over their brand and users. It offers comprehensive technology components essential for voice and AI integration, including swift speech recognition, sophisticated natural language understanding, user friendly developer tools, knowledge graphs, and an extensive range of domains. Houndify achieve this from a decade of dedicated research and development efforts.

The Hound voice search and assistant app speech to meaning and deep meaning understanding technologies at the consumer app level. Meanwhile, the SoundHound AI music recognition app enhances the listening experience by enabling users to explore, discover, and share music with there environment.

SoundHound AI stock(NASDAQ: SOUN) made its public debut through a merger with a special purpose acquisition company in April last year. The renowned audio and speech recognition firm saw its stock trading at $8.72 and all-time peak of $14.98 within a month.

The surge in SoundHound’s stock price was fueled by the expanding generative AI market, This is AI tools has a fervor among investors for AI related stocks. and more, SoundHound prove itself by offering speech recognition services that provided users and clients with more freedom compared to the closed ecosystems of tech company like Alphabet Google and Microsoft.

However, by November, SoundHound’s stock had down to approximately $2. The company appeal waned as revenue growth slowed down, coupled with significant losses. SoundHound failed to meet its pre-merger projections, and the impact of rising interest rates further intensified the situation by reducing its valuations.

Now, the question arises: Can this AI stock, which has fallen out of favor, rebound within the next 12 months?

Over the past year, SoundHound experienced various shifts in its financial performance. While the company’s revenue surged by 47% to reach $31 million in 2022, surpassing its pre-merger estimate of 41% growth, it also faced challenges.

| Metric | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 |

|---|---|---|---|---|---|

| Revenue Growth (YOY) | 178% | 84% | 56% | 42% | 19% |

| Gross Margin | 77% | 71% | 71% | 79% | 73% |

| Adjusted EBITDA Margin | (151%) | (196%) | (221%) | (113%) | (55%) |

soundhound ai attributed much of its recent slowdown to macroeconomic challenges, which prompted numerous companies to scale back their software expenditures. However, the company anticipates a resurgence in revenue growth for the fourth quarter, projecting a year over year increase ranging from 68% to 111%.

This forecast suggests a full year revenue growth rate between 44% and 57%, notably lower than its pre-merger projection of 245% for 2023 but aligns with its earlier estimate of “approximately 50%” growth. Additionally, SoundHound achieving positive adjusted EBITDA in the fourth quarter by optimizing its expenses.

After it public listing, soundhound ai initially workforce reductions, first by laying off 10% of its employees and after that letting go of approximately half of its remaining workforce in early 2023.

SoundHound AI stock in 2024?

Analysts is seeing soundhound ai revenue to increase by 50% to $47 million for the full year, with its adjusted EBITDA loss expected to narrow from $73 million to $33 million. Looking ahead in 2024, revenue is projected to grow by 51% to $70 million, with an adjusted EBITDA loss of $5 million. With these projections and its enterprise value of $533 million, soundhound ai appears reasonably valued at seven times next year sales.

During the recent conference call, CFO Nitesh Sharan expressed confidence in the company’s future, noting its strong positioning and growth opportunities. He highlighted existing contracts providing visibility for future growth, apart from challenges larger customers in a dynamic environment. Sharan remained optimistic about the growth trajectory leading into 2024 and beyond.

CEO Keyvan Mohajer echoed Sharan’s sentiments, foreseeing SoundHound’s new large language models propelling the platform to new heights as the generative AI market expands. With established partnerships with key clients such as Hyundai, Stellantis, Vizio, and White Castle, soundhound ai is poised for further growth as more companies integrate AI driven voice recognition features into their offerings.

For other AI tools explore this power full article 10 best AI tools Anime ai art generator

(soundhound ai stock, soundhound ai stock forecast, soundhound ai stock price, soundhound ai news, best ai stocks)